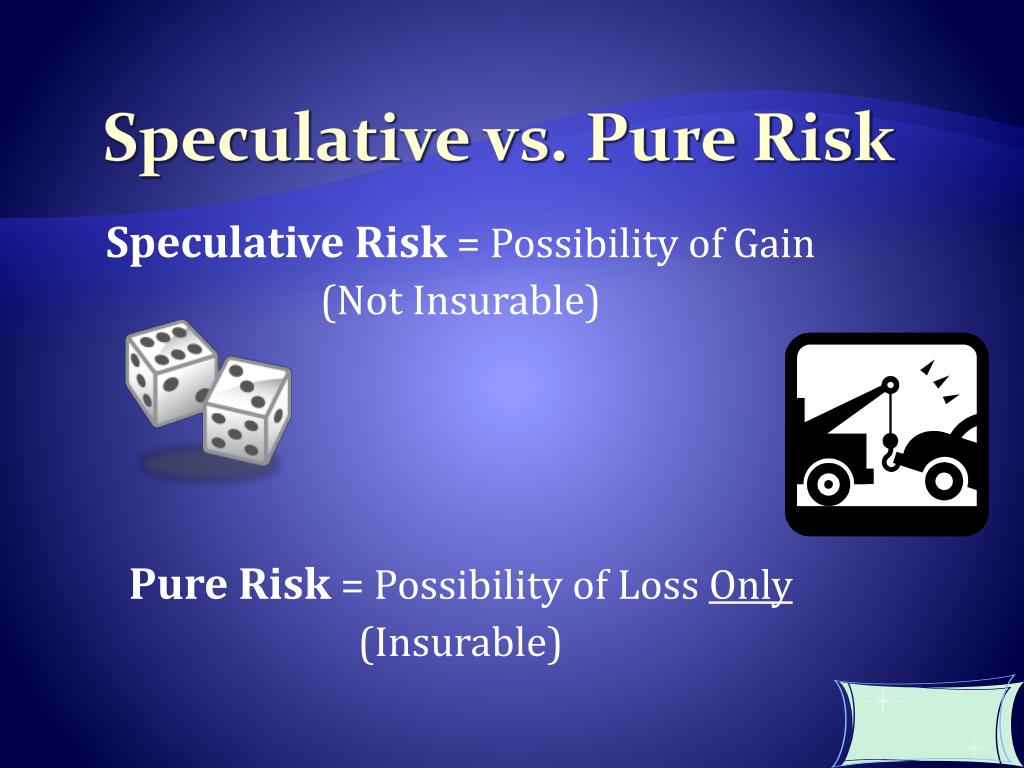

Speculative Risk Can Be Insured . speculative risks are not insurable. — speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or. — speculative risks are almost never insured by insurance companies. Insurance companies require policyholders to submit proof of loss (often via bills) before they. — speculative risks are almost never insured by insurance companies, unlike pure risks. Part of your job as an insurance underwriter is to determine whether the risks you’re being asked to underwrite are pure risks or speculative risks. — speculative risk is action or inaction that has potential for both gain and loss. Both speculative risk and pure risk involve the possibility of loss. speculative risk and insurance. This can be contrasted with pure risk that only has potential for. speculative risks in insurance have some defining characteristics:

from www.slideserve.com

— speculative risks are almost never insured by insurance companies. — speculative risk is action or inaction that has potential for both gain and loss. — speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or. Insurance companies require policyholders to submit proof of loss (often via bills) before they. This can be contrasted with pure risk that only has potential for. Both speculative risk and pure risk involve the possibility of loss. — speculative risks are almost never insured by insurance companies, unlike pure risks. speculative risks in insurance have some defining characteristics: speculative risks are not insurable. Part of your job as an insurance underwriter is to determine whether the risks you’re being asked to underwrite are pure risks or speculative risks.

PPT Continuing Education PowerPoint Presentation, free download ID

Speculative Risk Can Be Insured Part of your job as an insurance underwriter is to determine whether the risks you’re being asked to underwrite are pure risks or speculative risks. — speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or. Both speculative risk and pure risk involve the possibility of loss. — speculative risk is action or inaction that has potential for both gain and loss. — speculative risks are almost never insured by insurance companies. Insurance companies require policyholders to submit proof of loss (often via bills) before they. speculative risks in insurance have some defining characteristics: Part of your job as an insurance underwriter is to determine whether the risks you’re being asked to underwrite are pure risks or speculative risks. speculative risks are not insurable. — speculative risks are almost never insured by insurance companies, unlike pure risks. speculative risk and insurance. This can be contrasted with pure risk that only has potential for.

From exonpxgws.blob.core.windows.net

Speculative Risk Meaning And Examples at Basil Wade blog Speculative Risk Can Be Insured — speculative risk is action or inaction that has potential for both gain and loss. Insurance companies require policyholders to submit proof of loss (often via bills) before they. speculative risk and insurance. Both speculative risk and pure risk involve the possibility of loss. speculative risks are not insurable. — speculative risks are almost never insured. Speculative Risk Can Be Insured.

From www.hecet.com

Which Is An Example Of A Speculative Business Risk Speculative Risk Can Be Insured — speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or. speculative risks in insurance have some defining characteristics: Insurance companies require policyholders to submit proof of loss (often via bills) before they. This can be contrasted with pure risk that only has potential for. . Speculative Risk Can Be Insured.

From exonpxgws.blob.core.windows.net

Speculative Risk Meaning And Examples at Basil Wade blog Speculative Risk Can Be Insured speculative risks are not insurable. — speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or. This can be contrasted with pure risk that only has potential for. speculative risks in insurance have some defining characteristics: speculative risk and insurance. Part of your job. Speculative Risk Can Be Insured.

From diringkas.com

How to Deal with Speculative Risk, and What Is It? Speculative Risk Can Be Insured speculative risk and insurance. — speculative risks are almost never insured by insurance companies. This can be contrasted with pure risk that only has potential for. Insurance companies require policyholders to submit proof of loss (often via bills) before they. Part of your job as an insurance underwriter is to determine whether the risks you’re being asked to. Speculative Risk Can Be Insured.

From www.slideserve.com

PPT Introduction to Risk Management PowerPoint Presentation, free Speculative Risk Can Be Insured — speculative risks are almost never insured by insurance companies. speculative risks in insurance have some defining characteristics: This can be contrasted with pure risk that only has potential for. — speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or. — speculative risk. Speculative Risk Can Be Insured.

From exonpxgws.blob.core.windows.net

Speculative Risk Meaning And Examples at Basil Wade blog Speculative Risk Can Be Insured This can be contrasted with pure risk that only has potential for. speculative risks are not insurable. Part of your job as an insurance underwriter is to determine whether the risks you’re being asked to underwrite are pure risks or speculative risks. Insurance companies require policyholders to submit proof of loss (often via bills) before they. Both speculative risk. Speculative Risk Can Be Insured.

From www.slideteam.net

Pure Risk Speculative Risk Ppt Powerpoint Presentation Infographics Speculative Risk Can Be Insured speculative risks in insurance have some defining characteristics: Both speculative risk and pure risk involve the possibility of loss. — speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or. Insurance companies require policyholders to submit proof of loss (often via bills) before they. —. Speculative Risk Can Be Insured.

From www.youtube.com

TYPES OF RISK IN INSURANCE PURE RISK SPECULATIVE RISK STATIC Speculative Risk Can Be Insured speculative risks are not insurable. — speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or. Part of your job as an insurance underwriter is to determine whether the risks you’re being asked to underwrite are pure risks or speculative risks. speculative risk and insurance.. Speculative Risk Can Be Insured.

From www.slideserve.com

PPT Explain why risk is inevitable. Describe speculative risk Speculative Risk Can Be Insured speculative risks are not insurable. — speculative risks are almost never insured by insurance companies. Part of your job as an insurance underwriter is to determine whether the risks you’re being asked to underwrite are pure risks or speculative risks. This can be contrasted with pure risk that only has potential for. — speculative risk is the. Speculative Risk Can Be Insured.

From slideplayer.com

Business Risk. ppt download Speculative Risk Can Be Insured speculative risk and insurance. — speculative risks are almost never insured by insurance companies. Insurance companies require policyholders to submit proof of loss (often via bills) before they. speculative risks are not insurable. — speculative risk is action or inaction that has potential for both gain and loss. This can be contrasted with pure risk that. Speculative Risk Can Be Insured.

From slideplayer.com

Chapter 9 The Insurance Decision The Concept of Risk Risk is the Speculative Risk Can Be Insured speculative risks in insurance have some defining characteristics: — speculative risk is action or inaction that has potential for both gain and loss. speculative risks are not insurable. This can be contrasted with pure risk that only has potential for. — speculative risk is the opposite of pure risk, which is a risk that is inevitable. Speculative Risk Can Be Insured.

From www.slideserve.com

PPT Chapter 22 PowerPoint Presentation, free download ID4732104 Speculative Risk Can Be Insured speculative risk and insurance. — speculative risks are almost never insured by insurance companies, unlike pure risks. Both speculative risk and pure risk involve the possibility of loss. speculative risks in insurance have some defining characteristics: speculative risks are not insurable. Part of your job as an insurance underwriter is to determine whether the risks you’re. Speculative Risk Can Be Insured.

From slidetodoc.com

RISK MANAGEMENT WHAT IS RISK Risk is defined Speculative Risk Can Be Insured Insurance companies require policyholders to submit proof of loss (often via bills) before they. This can be contrasted with pure risk that only has potential for. — speculative risk is action or inaction that has potential for both gain and loss. — speculative risk is the opposite of pure risk, which is a risk that is inevitable and. Speculative Risk Can Be Insured.

From www.slideserve.com

PPT Introduction to Risk Management PowerPoint Presentation, free Speculative Risk Can Be Insured speculative risks in insurance have some defining characteristics: speculative risks are not insurable. — speculative risks are almost never insured by insurance companies, unlike pure risks. — speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or. Both speculative risk and pure risk involve. Speculative Risk Can Be Insured.

From www.slideserve.com

PPT RISK MANAGEMENT & INSURANCE PowerPoint Presentation, free Speculative Risk Can Be Insured speculative risks are not insurable. speculative risks in insurance have some defining characteristics: — speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or. Part of your job as an insurance underwriter is to determine whether the risks you’re being asked to underwrite are pure. Speculative Risk Can Be Insured.

From www.slideserve.com

PPT Risk Management PowerPoint Presentation, free download ID2876250 Speculative Risk Can Be Insured Part of your job as an insurance underwriter is to determine whether the risks you’re being asked to underwrite are pure risks or speculative risks. — speculative risk is the opposite of pure risk, which is a risk that is inevitable and can result in either loss or. — speculative risk is action or inaction that has potential. Speculative Risk Can Be Insured.

From www.youtube.com

BASIC CATEGORIES OF RISK (Speculative or Dynamic Risk & Pure or Static Speculative Risk Can Be Insured speculative risk and insurance. Part of your job as an insurance underwriter is to determine whether the risks you’re being asked to underwrite are pure risks or speculative risks. — speculative risks are almost never insured by insurance companies. — speculative risk is action or inaction that has potential for both gain and loss. speculative risks. Speculative Risk Can Be Insured.

From www.slideshare.net

Insurance And Risk Speculative Risk Can Be Insured Part of your job as an insurance underwriter is to determine whether the risks you’re being asked to underwrite are pure risks or speculative risks. speculative risk and insurance. Insurance companies require policyholders to submit proof of loss (often via bills) before they. — speculative risks are almost never insured by insurance companies. speculative risks are not. Speculative Risk Can Be Insured.